As the month of February draws to a close, we come to the fourth conference in our offseason sojourn, the Big 12.

Here are the Big 12 standings.

So we know what each team achieved, but how did they perform? To answer that, here are the Yards Per Play (YPP), Yards Per Play Allowed (YPA) and Net Yards Per Play (Net) numbers for each Big 12 team. This includes conference play only, with the championship game not included. The teams are sorted by Net YPP with conference rank in parentheses.

College football teams play either eight or nine conference games. Consequently, their record in such a small sample may not be indicative of their quality of play. A few fortuitous bounces here or there can be the difference between another ho-hum campaign or a special season. Randomness and other factors outside of our perception play a role in determining the standings. It would be fantastic if college football teams played 100 or even 1000 games. Then we could have a better idea about which teams were really the best. Alas, players would miss too much class time, their bodies would be battered beyond recognition, and I would never leave the couch. As it is, we have to make do with the handful of games teams do play. In those games, we can learn a lot from a team’s YPP. Since 2005, I have collected YPP data for every conference. I use conference games only because teams play such divergent non-conference schedules and the teams within a conference tend to be of similar quality. By running a regression analysis between a team’s Net YPP (the difference between their Yards Per Play and Yards Per Play Allowed) and their conference winning percentage, we can see if Net YPP is a decent predictor of a team’s record. Spoiler alert. It is. For the statistically inclined, the correlation coefficient between a team’s Net YPP in conference play and their conference record is around .66. Since Net YPP is a solid predictor of a team’s conference record, we can use it to identify which teams had a significant disparity between their conference record as predicted by Net YPP and their actual conference record. I used a difference of .200 between predicted and actual winning percentage as the threshold for ‘significant’. Why .200? It is a little arbitrary, but .200 corresponds to a difference of 1.6 games over an eight game conference schedule and 1.8 games over a nine game one. Over or under-performing by more than a game and a half in a small sample seems significant to me. In the 2019 season, which teams in the Big 12 met this threshold? Here are Big 12 teams sorted by performance over what would be expected from their Net YPP numbers.

Both teams from The Sunflower State saw their actual record differ significantly from their expected record. For Kansas State, and their first year head coach Chris Klieman, the difference was positive. The Wildcats were a solid 3-2 in one-score conference games and also boasted a non-offensive touchdown net ratio of +3. The Wildcats returned three kickoffs for touchdowns in Big 12 play while allowing none. Those kickoff returns kept them close in a loss to West Virginia, provided the winning margin in a victory over Texas Tech, and extended the margin in a tight game with Iowa State. Meanwhile, Kansas, also led by a first year (for them) head coach, went 1-2 in one-score games and finished tied for last in in-conference turnover margin at -8.

Purple Magic Continues in Manhattan

I have made no secret of my affinity for Bill Snyder on this blog. Regarded by me, often seen as the authority on all things college football (don’t bother looking it up), as the best college football coach in history, 2019 marked just the fourth season Snyder was not roaming the sidelines in the past thirty years. His replacement, Chris Klieman, did a fine Snyder impression, at least in regards in doing more with less, if not in general curmudgeonyness. Allow me to explain what I mean.

When Bill Snyder initially revitalized (or vitalized if you want to get technical) the Kansas State program in the mid-90s, one of the ways he managed to acquire talent was through the junior college ranks (JUCOs). A somewhat novel way to recruit talent to an outpost like Manhattan, Kansas was to take chances on players that could not get into FBS institutions out of high school or were forced to leave FBS institutions once they arrived. As an early adopter of the strategy, this netted Snyder a number of talented players that otherwise may have never considered Kansas State. As the new decade dawned and the Clinton era of prosperity gave way the Bush era of recession and war crimes, Kansas State’s early adopter advantage of using JUCOs began to diminish. After winning the Big 12 for the first time in 2003, the Wildcats finished with losing records in Bill Snyder’s final two seasons. He retired following the 2005 season and Ron Prince took over. He guided the Wildcats to the postseason in 2006, but posted consecutive losing seasons in 2007 and 2008 before being fired. Instead of bringing in a new coach, the Wildcats coaxed Snyder out of retirement. His second tenure lasted ten seasons and featured eight bowl appearances, another Big 12 title, and three appearances in the final AP Poll. He continued scouring the JUCO ranks for talent, but in his second tenure, Snyder’s teams also boasted an uncanny ability to consistently and significantly outperform their expected record based on YPP. Emphasizing special teams, red zone defense, and playing at a slow pace to limit the number of possessions, the Wildcats routinely hung with, and often beat superior teams. Using the same blueprint, Klieman managed to do the same thing in 2019.

In the eleven seasons (ten for Snyder and one for Klieman) since Snyder returned from his first retirement, Kansas State exceeded their expected record based on YPP by far more than any other Big 12 team. The following table lists the average amount each Big 12 team has over or under-performed relative to their expected YPP record since 2009. I have also included the number of seasons each team played in the Big 12 since the membership has changed significantly.

No other Big 12 team exceeded their expected record by more than an insignificant amount on average over the past eleven seasons. Being insignificantly above or below average is what one might expect as the sample size increases and the random close game or turnover luck evens out. However, over an eleven year span, Kansas State exceeded their expected YPP record on average by .159. To put this is in another context, this is the equivalent of about 1.25 game in an eight game conference season and 1.4 games over a nine game schedule. In addition, this is not the result of one massive season of Wildcat exceptionalism. Kansas State has finished as the biggest overachiever in the Big 12 five times in eleven seasons and has underachieved relative to YPP just once.

Obviously, one season is not a large enough sample to make any bold proclamations about Klieman's future at Kansas State. However, it was a great start, particularly in regards to how well the Wildcats performed relative to their YPP numbers. Were I a Kansas State fan, I would be cautiously optimistic the experienced FCS national champion coach could continue the wizardry in Manhattan.

I use many stats. I use many stats. Let me tell you, you have stats that are far worse than the ones that I use. I use many stats.

Thursday, February 27, 2020

Thursday, February 20, 2020

2019 Adjusted Pythagorean Record: Big 10

Last week we looked at how Big 10 teams fared in terms of yards per play. This week, we turn our attention to how the season played out in terms of the Adjusted Pythagorean Record, or APR. For an in-depth look at APR, click here. If you didn’t feel like clicking, here is the Reader’s Digest version. APR looks at how well a team scores and prevents touchdowns. Non-offensive touchdowns, field goals, extra points, and safeties are excluded. The ratio of offensive touchdowns to touchdowns allowed is converted into a winning percentage. Pretty simple actually.

Once again, here are the 2019 Big 10 standings.

And here are the APR standings with conference rank in offensive touchdowns, touchdowns allowed, and APR in parentheses. This includes conference games only with the championship game excluded.

Finally, Big 10 teams are sorted by the difference between their actual number of wins and their expected number of wins according to APR.

I use a game and a half as a line of demarcation to determine whether or not a team significantly over or under-performed relative to their APR and by that standard, no team saw their record differ significantly from their APR. Michigan State came close, but I found something more interesting about the Spartans I wanted to discuss.

East V West

Prior to the 2014 season, the Big 10 scrapped the maligned Leaders and Legends division format in favor of the more geographically inclined (if uncreative) East and West. The conference also added Maryland and Rutgers and has been stable, membership wise, for the past six seasons. In those six seasons, the Big 10 East has dominated the West in the Big 10 Championship Game. The East champion has won all six meetings, with three of the victories coming by double-digits. However, the West has held their own against the East in the regular season interdivision showdowns.

The East has finished with a winning record against the West just three times in six seasons and outside of 2017, the results have been pretty even with neither division finishing more than a game up on the other. Most college football fans and Big 10 aficionados in particular, probably assume the Big 4 in the East (Michigan, Michigan State, Ohio State, and Penn State) are doing all the heavy lifting for the division with the remaining filler (Indiana, Maryland, and Rutgers) dragging the East’s record down. And those college football fans would be mostly right. Or 75% right to put a number on it.

Michigan State has not pulled their weight for the East, finishing with the same interdivision record as Indiana. In fact, since their College Football Playoff appearance in 2015, the Spartans are 4-8 against Big 10 West opponents. Mark Dantonio surprisingly stepped down immediately following the second National Signing Day, so the task of reinvigorating the program falls to Mel Tucker.The schedule is daunting with Michigan, Ohio State, and Penn State, but Tucker’s long term success will probably come down to whether or not he can beat the trio of Big 10 West teams that annually dot the schedule.

Thanks for reading. Next week we move to flyover country and the Big 12.

Once again, here are the 2019 Big 10 standings.

And here are the APR standings with conference rank in offensive touchdowns, touchdowns allowed, and APR in parentheses. This includes conference games only with the championship game excluded.

Finally, Big 10 teams are sorted by the difference between their actual number of wins and their expected number of wins according to APR.

I use a game and a half as a line of demarcation to determine whether or not a team significantly over or under-performed relative to their APR and by that standard, no team saw their record differ significantly from their APR. Michigan State came close, but I found something more interesting about the Spartans I wanted to discuss.

East V West

Prior to the 2014 season, the Big 10 scrapped the maligned Leaders and Legends division format in favor of the more geographically inclined (if uncreative) East and West. The conference also added Maryland and Rutgers and has been stable, membership wise, for the past six seasons. In those six seasons, the Big 10 East has dominated the West in the Big 10 Championship Game. The East champion has won all six meetings, with three of the victories coming by double-digits. However, the West has held their own against the East in the regular season interdivision showdowns.

The East has finished with a winning record against the West just three times in six seasons and outside of 2017, the results have been pretty even with neither division finishing more than a game up on the other. Most college football fans and Big 10 aficionados in particular, probably assume the Big 4 in the East (Michigan, Michigan State, Ohio State, and Penn State) are doing all the heavy lifting for the division with the remaining filler (Indiana, Maryland, and Rutgers) dragging the East’s record down. And those college football fans would be mostly right. Or 75% right to put a number on it.

Michigan State has not pulled their weight for the East, finishing with the same interdivision record as Indiana. In fact, since their College Football Playoff appearance in 2015, the Spartans are 4-8 against Big 10 West opponents. Mark Dantonio surprisingly stepped down immediately following the second National Signing Day, so the task of reinvigorating the program falls to Mel Tucker.The schedule is daunting with Michigan, Ohio State, and Penn State, but Tucker’s long term success will probably come down to whether or not he can beat the trio of Big 10 West teams that annually dot the schedule.

Thanks for reading. Next week we move to flyover country and the Big 12.

Thursday, February 13, 2020

2019 Yards Per Play: Big 10

After examining the coastal elites (or lack thereof) in the ACC, we now turn our attention to the heartland of America and the Big 10.

Here are the Big 10 standings.

So we know what each team achieved, but how did they perform? To answer that, here are the Yards Per Play (YPP), Yards Per Play Allowed (YPA) and Net Yards Per Play (Net) numbers for each Big 10 team. This includes conference play only, with the championship game not included. The teams are sorted by division by Net YPP with conference rank in parentheses.

College football teams play either eight or nine conference games. Consequently, their record in such a small sample may not be indicative of their quality of play. A few fortuitous bounces here or there can be the difference between another ho-hum campaign or a special season. Randomness and other factors outside of our perception play a role in determining the standings. It would be fantastic if college football teams played 100 or even 1000 games. Then we could have a better idea about which teams were really the best. Alas, players would miss too much class time, their bodies would be battered beyond recognition, and I would never leave the couch. As it is, we have to make do with the handful of games teams do play. In those games, we can learn a lot from a team’s YPP. Since 2005, I have collected YPP data for every conference. I use conference games only because teams play such divergent non-conference schedules and the teams within a conference tend to be of similar quality. By running a regression analysis between a team’s Net YPP (the difference between their Yards Per Play and Yards Per Play Allowed) and their conference winning percentage, we can see if Net YPP is a decent predictor of a team’s record. Spoiler alert. It is. For the statistically inclined, the correlation coefficient between a team’s Net YPP in conference play and their conference record is around .66. Since Net YPP is a solid predictor of a team’s conference record, we can use it to identify which teams had a significant disparity between their conference record as predicted by Net YPP and their actual conference record. I used a difference of .200 between predicted and actual winning percentage as the threshold for ‘significant’. Why .200? It is a little arbitrary, but .200 corresponds to a difference of 1.6 games over an eight game conference schedule and 1.8 games over a nine game one. Over or under-performing by more than a game and a half in a small sample seems significant to me. In the 2019 season, which teams in the Big 10 met this threshold? Here are Big 10 teams sorted by performance over what would be expected from their Net YPP numbers.

No Big 10 team significantly over or under-performed relative to their expected record based on YPP. Northwestern was on track for a winless Big 10 season despite bad, but far from horrific YPP margins, but the Wildcats dominated Illinois in their season finale to avoid both the goose egg and showing up on this list.

The Worst Ever Ranked Teams

Last offseason in the Big 10 YPP post, I examined some of the worst head coaches (by win percentage) to ever get a second head coaching job. The post was basically a hit piece on incoming Maryland coach Mike Locksley. To the surprise of no one, Locksley fell on his face in his first full year coaching the Terrapins. Maryland defeated an FCS team, a team that went winless in the Big 10, and a team that finished with the second worst conference record in the ACC. They lost their other nine games by an average of more than thirty points per game and ended the year on a seven game losing streak. However, in the process, Maryland did manage to do something truly historic.

Maryland did not begin the season in the top 25 of the AP Poll. Why would they? The team was coming off a 5-7 campaign and had not won more than seven games in a season in nearly a decade. However, thanks to an easy opening schedule, the Terrapins were able to build some momentum a fortnight into the season. Maryland recorded a dominating 79-0 victory against Howard in their season opener and followed that up with an impressive (at the time) six touchdown win against a ranked Syracuse team. Two weeks into the season, Maryland climbed into the polls at number 21. All they had to do to maintain their perch in the AP Poll was win on the road against an AAC team that was on its third head coach in nine months. The heretofore explosive Maryland offense managed just 17 points against Temple and fell out of the rankings, never to be seen again in 2019. After the loss, Maryland managed just one victory the rest of the way and in the process became the worst team (record wise) in the past thirty seasons (since 1989) to ever start the season unranked and later enter the polls. In my opinion, this is a more impressive feat than being the worst team to ever start the season ranked in the preseason AP Poll. Once you get outside of the top fifteen, the preseason AP Poll is a lot of guess work and conjecture buoyed by a brutally long offseason packed with narratives. By contrast, a team that is unranked in the preseason, but later enters the poll and still ends up being bad has provided the pollsters with at least one, and in Maryland’s case two, data points in their evaluation.

Who are the other members of this illustrious rogues' gallery of bad teams? Along with Maryland, six other teams since 1989 have started the season unranked in the AP Poll, later entered the poll, and won four games are fewer. They are presented below for your viewing pleasure.

Some interesting minutia before I close: South Carolina achieved the highest ranking of these teams at 19th. The Gamecocks opened the 1993 season by winning at fourteenth ranked Georgia and spring boarding into the polls. They followed that victory with a one point loss at Arkansas and despite being 2-1, 3-3, and 4-4 at various points in the season, the closing stretch of Tennessee, Florida, and Clemson (all ranked at the time South Carolina played them) doomed the Gamecocks to a 4-7 finish. Despite not being ranked in the preseason AP Poll, Stanford was actually ranked by the time they played their first game in 1994. The Cardinal had a bye week over Labor Day Weekend and moved up to 24th by the time they headed to Northwestern for their opener. The Cardinal tied the Wildcats and fell out of the poll for the remainder of the season. UCLA did not even get to play a game as a ranked team in 2008. They opened the season by upsetting eighteenth ranked Tennessee in their first game under Rick Neuheisel. They moved into the rankings following the game, but had a bye before their second game. During the bye, they fell out of the polls and were walloped by BYU 59-0 in their next game. Needless to say, they did not sniff the polls for the rest of the season.

I know we have a lot of fun at Mike Locksley’s expense on this blog, but I give credit where credit is due. Locksley’s three wins in 2019 equaled his career total going in to the 2019 season and actually upped his career winning percentage to a sterling .130. Check back next week when we give the Big 10 the APR treatment.

Here are the Big 10 standings.

So we know what each team achieved, but how did they perform? To answer that, here are the Yards Per Play (YPP), Yards Per Play Allowed (YPA) and Net Yards Per Play (Net) numbers for each Big 10 team. This includes conference play only, with the championship game not included. The teams are sorted by division by Net YPP with conference rank in parentheses.

College football teams play either eight or nine conference games. Consequently, their record in such a small sample may not be indicative of their quality of play. A few fortuitous bounces here or there can be the difference between another ho-hum campaign or a special season. Randomness and other factors outside of our perception play a role in determining the standings. It would be fantastic if college football teams played 100 or even 1000 games. Then we could have a better idea about which teams were really the best. Alas, players would miss too much class time, their bodies would be battered beyond recognition, and I would never leave the couch. As it is, we have to make do with the handful of games teams do play. In those games, we can learn a lot from a team’s YPP. Since 2005, I have collected YPP data for every conference. I use conference games only because teams play such divergent non-conference schedules and the teams within a conference tend to be of similar quality. By running a regression analysis between a team’s Net YPP (the difference between their Yards Per Play and Yards Per Play Allowed) and their conference winning percentage, we can see if Net YPP is a decent predictor of a team’s record. Spoiler alert. It is. For the statistically inclined, the correlation coefficient between a team’s Net YPP in conference play and their conference record is around .66. Since Net YPP is a solid predictor of a team’s conference record, we can use it to identify which teams had a significant disparity between their conference record as predicted by Net YPP and their actual conference record. I used a difference of .200 between predicted and actual winning percentage as the threshold for ‘significant’. Why .200? It is a little arbitrary, but .200 corresponds to a difference of 1.6 games over an eight game conference schedule and 1.8 games over a nine game one. Over or under-performing by more than a game and a half in a small sample seems significant to me. In the 2019 season, which teams in the Big 10 met this threshold? Here are Big 10 teams sorted by performance over what would be expected from their Net YPP numbers.

No Big 10 team significantly over or under-performed relative to their expected record based on YPP. Northwestern was on track for a winless Big 10 season despite bad, but far from horrific YPP margins, but the Wildcats dominated Illinois in their season finale to avoid both the goose egg and showing up on this list.

The Worst Ever Ranked Teams

Last offseason in the Big 10 YPP post, I examined some of the worst head coaches (by win percentage) to ever get a second head coaching job. The post was basically a hit piece on incoming Maryland coach Mike Locksley. To the surprise of no one, Locksley fell on his face in his first full year coaching the Terrapins. Maryland defeated an FCS team, a team that went winless in the Big 10, and a team that finished with the second worst conference record in the ACC. They lost their other nine games by an average of more than thirty points per game and ended the year on a seven game losing streak. However, in the process, Maryland did manage to do something truly historic.

Maryland did not begin the season in the top 25 of the AP Poll. Why would they? The team was coming off a 5-7 campaign and had not won more than seven games in a season in nearly a decade. However, thanks to an easy opening schedule, the Terrapins were able to build some momentum a fortnight into the season. Maryland recorded a dominating 79-0 victory against Howard in their season opener and followed that up with an impressive (at the time) six touchdown win against a ranked Syracuse team. Two weeks into the season, Maryland climbed into the polls at number 21. All they had to do to maintain their perch in the AP Poll was win on the road against an AAC team that was on its third head coach in nine months. The heretofore explosive Maryland offense managed just 17 points against Temple and fell out of the rankings, never to be seen again in 2019. After the loss, Maryland managed just one victory the rest of the way and in the process became the worst team (record wise) in the past thirty seasons (since 1989) to ever start the season unranked and later enter the polls. In my opinion, this is a more impressive feat than being the worst team to ever start the season ranked in the preseason AP Poll. Once you get outside of the top fifteen, the preseason AP Poll is a lot of guess work and conjecture buoyed by a brutally long offseason packed with narratives. By contrast, a team that is unranked in the preseason, but later enters the poll and still ends up being bad has provided the pollsters with at least one, and in Maryland’s case two, data points in their evaluation.

Who are the other members of this illustrious rogues' gallery of bad teams? Along with Maryland, six other teams since 1989 have started the season unranked in the AP Poll, later entered the poll, and won four games are fewer. They are presented below for your viewing pleasure.

Some interesting minutia before I close: South Carolina achieved the highest ranking of these teams at 19th. The Gamecocks opened the 1993 season by winning at fourteenth ranked Georgia and spring boarding into the polls. They followed that victory with a one point loss at Arkansas and despite being 2-1, 3-3, and 4-4 at various points in the season, the closing stretch of Tennessee, Florida, and Clemson (all ranked at the time South Carolina played them) doomed the Gamecocks to a 4-7 finish. Despite not being ranked in the preseason AP Poll, Stanford was actually ranked by the time they played their first game in 1994. The Cardinal had a bye week over Labor Day Weekend and moved up to 24th by the time they headed to Northwestern for their opener. The Cardinal tied the Wildcats and fell out of the poll for the remainder of the season. UCLA did not even get to play a game as a ranked team in 2008. They opened the season by upsetting eighteenth ranked Tennessee in their first game under Rick Neuheisel. They moved into the rankings following the game, but had a bye before their second game. During the bye, they fell out of the polls and were walloped by BYU 59-0 in their next game. Needless to say, they did not sniff the polls for the rest of the season.

I know we have a lot of fun at Mike Locksley’s expense on this blog, but I give credit where credit is due. Locksley’s three wins in 2019 equaled his career total going in to the 2019 season and actually upped his career winning percentage to a sterling .130. Check back next week when we give the Big 10 the APR treatment.

Thursday, February 06, 2020

2019 Adjusted Pythagorean Record: ACC

Last week we looked at how ACC teams fared in terms of yards per play. This week, we turn our attention to how the season played out in terms of the Adjusted Pythagorean Record, or APR. For an in-depth look at APR, click here. If you didn’t feel like clicking, here is the Reader’s Digest version. APR looks at how well a team scores and prevents touchdowns. Non-offensive touchdowns, field goals, extra points, and safeties are excluded. The ratio of offensive touchdowns to touchdowns allowed is converted into a winning percentage. Pretty simple actually.

Once again, here are the 2019 ACC standings.

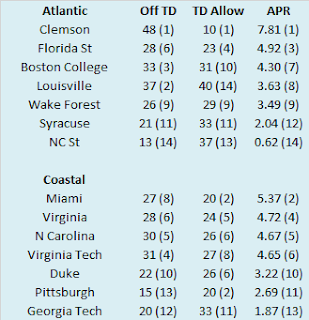

And here are the APR standings with conference rank in offensive touchdowns, touchdowns allowed, and APR in parentheses. This includes conference games only with the championship game excluded.

Finally, ACC teams are sorted by the difference between their actual number of wins and their expected number of wins according to APR.

I use a game and a half as a line of demarcation to determine whether or not a team significantly over or under-performed relative to their APR and by that standard, no team saw their record differ significantly from their APR. Thus we can move on to more important affairs.

Only 90's Kids Will Understand

The ACC has been around since 1953 and in those 67 seasons, no team has done what Clemson has over the past five seasons. The Tigers are on a streak of five consecutive outright conference titles. Of course, framing their accomplishment in this manner does a bit of a disservice to the 90’s version of Florida State. The Seminoles won or shared the conference title for nine consecutive seasons (1992-2000), but since there was no division structure or conference title game, their 1995 (Virginia) and 1998 (Georgia Tech) titles were shared, meaning they never won more than three consecutive outright titles.

With the ACC closely resembling its 90’s self (one dominant team and a host of decent to bad teams), I decided to look and see how the Clemson teams of the past five seasons compared to Florida State’s first five seasons in the ACC (1992-1996). Unfortunately, I don’t have access to individual game box scores, so I am not able to calculate YPP or APR data for those great Florida State teams. Instead, scoring margin in conference play will have to suffice. This analysis will include regular season conference play only, so any non-conference games and the ACC Championship Game for Clemson will not be included. Let’s start by looking at Florida State. Here are the Seminoles ACC scoring margins for their first five seasons.

I was surprised how (relatively) competitive the rest of the ACC was in Florida State’s first season. The Seminoles still outscored their conference opponents by over 20 points per game, but two teams (Clemson and Georgia Tech) played them within a touchdown and another (Virginia) only lost by ten points. I was surprised how dominant the 1993 team (and eventual national champion) was. The Seminoles allowed just 51 points in their eight ACC games, pitching three shutouts, and holding six teams to seven points or fewer while winning by more than 40 points per game. The Seminoles slipped a little in 1994 and remained at about the same level in terms of scoring margin from 1994 through 1996 with the offense picking up the defense’s slack in 1995 and vice-versa in 1996. Now let’s look at the same numbers for Clemson.

The Tigers were somewhat dominant against their conference opponents from 2015 through 2017, but their Death Star was not fully operational until 2018. After beating their ACC foes by fourteen and a half points per game in 2017 (a number the classic Seminole teams would scoff at), Clemson has more than doubled that scoring margin over the past two season. Despite that uptick, Clemson’s scoring margin during their five year ACC title run is about a touchdown less than Florida State’s during their first five seasons in the conference. Clemson would need to maintain their current level of play for another three seasons or so before we could credibly talk about them in the same breath as those 90’s Florida State teams. Before we close this post, I also included Florida State and Clemson’s collective conference record over these five seasons as well as their number of one-score victories.

After winning two one score games in their first season in the conference, Florida State did not play in another one-score conference game until their infamous defeat at Virginia, a span of 24 straight games (or three full conference seasons). By contrast the longest Clemson has gone between one-score conference games is a little more than one season (ten games). As always, thanks for reading. Check back next week when we take a YPP dive through the Big 10.

Once again, here are the 2019 ACC standings.

And here are the APR standings with conference rank in offensive touchdowns, touchdowns allowed, and APR in parentheses. This includes conference games only with the championship game excluded.

Finally, ACC teams are sorted by the difference between their actual number of wins and their expected number of wins according to APR.

I use a game and a half as a line of demarcation to determine whether or not a team significantly over or under-performed relative to their APR and by that standard, no team saw their record differ significantly from their APR. Thus we can move on to more important affairs.

Only 90's Kids Will Understand

The ACC has been around since 1953 and in those 67 seasons, no team has done what Clemson has over the past five seasons. The Tigers are on a streak of five consecutive outright conference titles. Of course, framing their accomplishment in this manner does a bit of a disservice to the 90’s version of Florida State. The Seminoles won or shared the conference title for nine consecutive seasons (1992-2000), but since there was no division structure or conference title game, their 1995 (Virginia) and 1998 (Georgia Tech) titles were shared, meaning they never won more than three consecutive outright titles.

With the ACC closely resembling its 90’s self (one dominant team and a host of decent to bad teams), I decided to look and see how the Clemson teams of the past five seasons compared to Florida State’s first five seasons in the ACC (1992-1996). Unfortunately, I don’t have access to individual game box scores, so I am not able to calculate YPP or APR data for those great Florida State teams. Instead, scoring margin in conference play will have to suffice. This analysis will include regular season conference play only, so any non-conference games and the ACC Championship Game for Clemson will not be included. Let’s start by looking at Florida State. Here are the Seminoles ACC scoring margins for their first five seasons.

I was surprised how (relatively) competitive the rest of the ACC was in Florida State’s first season. The Seminoles still outscored their conference opponents by over 20 points per game, but two teams (Clemson and Georgia Tech) played them within a touchdown and another (Virginia) only lost by ten points. I was surprised how dominant the 1993 team (and eventual national champion) was. The Seminoles allowed just 51 points in their eight ACC games, pitching three shutouts, and holding six teams to seven points or fewer while winning by more than 40 points per game. The Seminoles slipped a little in 1994 and remained at about the same level in terms of scoring margin from 1994 through 1996 with the offense picking up the defense’s slack in 1995 and vice-versa in 1996. Now let’s look at the same numbers for Clemson.

The Tigers were somewhat dominant against their conference opponents from 2015 through 2017, but their Death Star was not fully operational until 2018. After beating their ACC foes by fourteen and a half points per game in 2017 (a number the classic Seminole teams would scoff at), Clemson has more than doubled that scoring margin over the past two season. Despite that uptick, Clemson’s scoring margin during their five year ACC title run is about a touchdown less than Florida State’s during their first five seasons in the conference. Clemson would need to maintain their current level of play for another three seasons or so before we could credibly talk about them in the same breath as those 90’s Florida State teams. Before we close this post, I also included Florida State and Clemson’s collective conference record over these five seasons as well as their number of one-score victories.

After winning two one score games in their first season in the conference, Florida State did not play in another one-score conference game until their infamous defeat at Virginia, a span of 24 straight games (or three full conference seasons). By contrast the longest Clemson has gone between one-score conference games is a little more than one season (ten games). As always, thanks for reading. Check back next week when we take a YPP dive through the Big 10.

Subscribe to:

Posts (Atom)